We may earn a commission if you click on a product link and make a purchase at no additional cost to you. For more information, please see our disclosure policy.

Resumes, cover letters, and looking professional – are the essential ingredients for your next job interview. You’ve got a list in your head of everything you’ll do: Smile, sit up straight, highlight your strengths, and… ask about salary and benefits. Because benefits can comprise up to 30 percent of your compensation, and because your

What to Expect from Your Next Job

- Health

Insurance : Healthinsurance is a crucial benefit that covers medicalexpenses , including doctor visits, hospital stays, and prescription medications. Having comprehensive health coverage ensures you and your family can access necessary healthcare services without incurring significant out-of-pocket costs. - Retirement Plans: Retirement plans, such as 401(k) or pension plans, help you save for the future. Employers often offer matching contributions, which can significantly boost your retirement

savings over time, providing financial security when you retire. - Paid Time Off (PTO): Paid time off includes vacation days, sick leave, and personal days. This benefit allows you to take necessary breaks and manage personal or family matters without losing income, contributing to a better work-life balance.

- Flexible Work Arrangements: Flexible work arrangements, such as

remote work options or flexible hours, provide greater control over your schedule. This can help reduce stress, increase job satisfaction, and improve overallproductivity by allowing you to work when and where you are most effective.

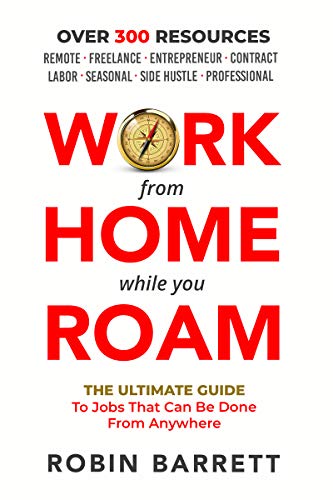

Forget the old concept that you must work now and live later. Escape the endless cycle that takes you from work to home then work again. Relieve financial tension without working a second job.

- Professional Development: Opportunities for professional development, including

training programs, workshops, and tuition reimbursement, show that your employer is invested in yourcareer growth . These benefits help you acquire new skills, advance in your field, and stay competitive in the job market. - Employee Assistance Programs (EAP): Employee Assistance Programs offer confidential support for personal and work-related issues. These programs can include counseling services, financial advice, and legal assistance, helping you navigate challenges and maintain mental and emotional well-being.

- Wellness Programs: Wellness programs promote a healthy lifestyle through initiatives like gym memberships, health screenings, and wellness challenges. These programs encourage physical activity and healthy habits, which can lead to improved overall health and reduced healthcare costs.

- Life

Insurance : Lifeinsurance provides financial protection for your family in the event of your death. Employer-provided lifeinsurance can offer peace of mind, knowing that your loved ones will have financial support to coverexpenses and maintain their standard of living. - Disability

Insurance : Disabilityinsurance replaces a portion of your income if you are unable to work due to illness or injury. This benefit ensures you can meet financial obligations and maintain stability during periods of short-term or long-term disability. - Parental Leave: Parental leave policies support employees who are welcoming a new child into their family. This benefit provides paid or unpaid leave, allowing parents to bond with their new child and adjust to their new family dynamics without the pressure of returning to work immediately.

Best work from home jobs and remote jobs in over 50 categories for professionals, digital nomads, telecommuting workers and entry level jobseekers.

Don’t Jump the Gun

Bringing up

There is a Time and Place

For your first and second interviews, chances are that you’re going to hear the stock phrases “full benefits,” or “competitive benefits and

This book makes it easier than ever to earn thousands of extra dollars because it adds many key concepts to the "bible" of salary negotiations.

Weigh Your Options

Some companies are going to offer better benefits than others. Make sure that you are fully aware of what your prospective employer is offering and whether or not it fits into your life. Find out if your spouse or partner will be covered, and be sure to ask about pre-existing conditions, as some plans require a waiting period before they will begin to cover them, and some won’t cover them at all. If lack of coverage in a certain area is a deal-breaker for you, remember that you don’t have to accept an offer just because it’s on the table.

Negotiate if Possible

The keywords here are “if possible.” If you’re relatively green in the job market and this is your first full-time job, you may not have as much negotiating power as, say, a seasoned vet with a performance-proven track record. Still, it can never hurt to try to bargain for things that you need. For example, if you or somebody in your family has a specific medical condition, your prospective employer may be open to finding you the right coverage for it. There are also companies out there that offer “cafeteria plans,” where you get to choose types of coverage from a list so that you and your family get benefits that are as form-fitted as possible.

Not All Companies Will Offer Benefits

It’s crucial to remember that some companies only offer a

Related posts:

Joey Trebif is the pen name of Mark Fiebert, a former finance executive who hired and managed dozens of professionals during his 30-plus-year career. He now shares expert job search, resume, and career advice on CareerAlley.com.